Investors often fail to meet their investment goals because active managers using traditional quantitative techniques struggle to deliver promised excess returns.

We believe that investors deserve better – better performance and better alignment.

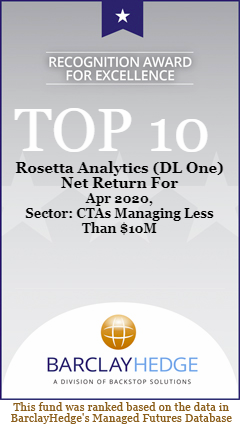

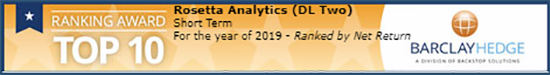

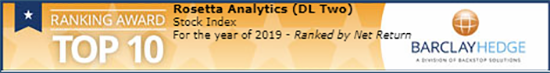

That’s why we started Rosetta Analytics–to provide investors with the returns they seek. We do this by using our own cutting-edge machine learning, the same type that continues to achieve amazing breakthroughs in medicine, autonomous driving, and robotics.